Nationwide settlement agreement lawyers

Navigating a settlement agreement can feel overwhelming, but our expert solicitors make it simple and stress-free. Our same-day, nationwide service ensures your agreement is reviewed, explained, and signed, so you can move forward with confidence.

Why choose our settlement agreement solicitors?

- Trusted expertise in same-day settlement agreements.

- Nationwide legal advice at no cost to you – your employer covers it.

- Fast, straightforward resolutions designed to protect your rights.

Our simple settlement agreement process.

We will help you in 3 easy steps.

Why trust us for your same-day settlement agreement?

0+

0+

0+

0

Over 500 Google

Reviews and Counting

What is a settlement agreement?

What is included in a settlement agreement?

Are settlement agreements taxable?

How much do settlement agreements cost?

Why should I instruct GTE Settlement Agreement solicitors?

What do you check in a settlement agreement?

Are settlement agreements confidential?

Latest from the

blog

Book your free consultation today

Simply call us today or complete the online enquiry form for your free, same-day consultation.

020 7247 7190Our solicitors are ready to review your settlement agreement and guide you through the process with expert, same-day advice.

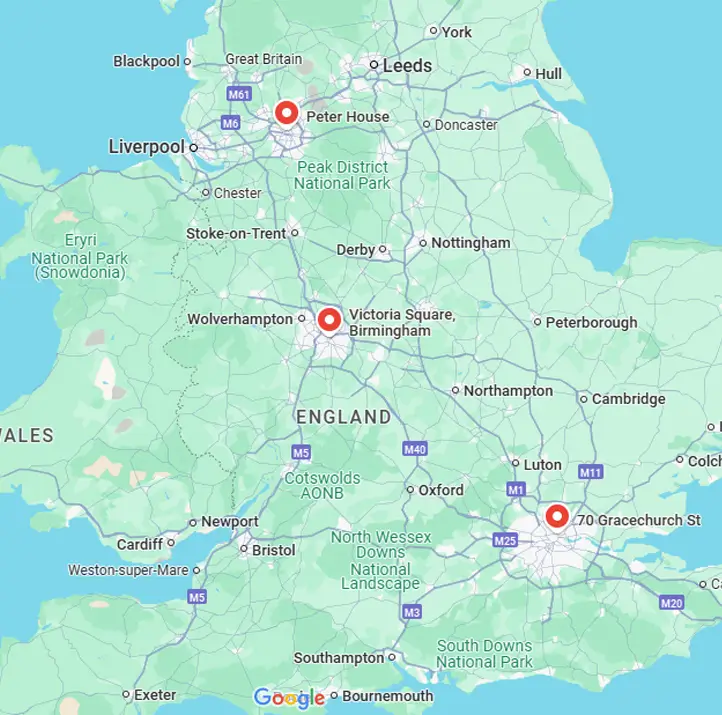

70 Gracechurch Street London EC3V OHR

70 Gracechurch Street London EC3V OHR

)

)

)